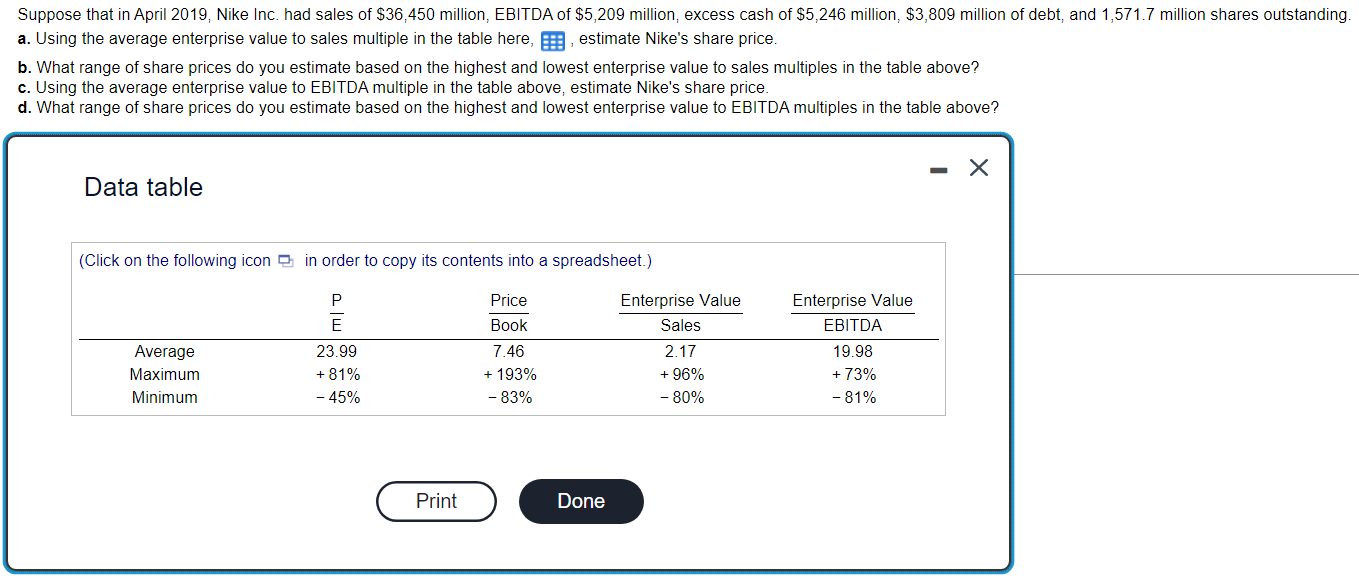

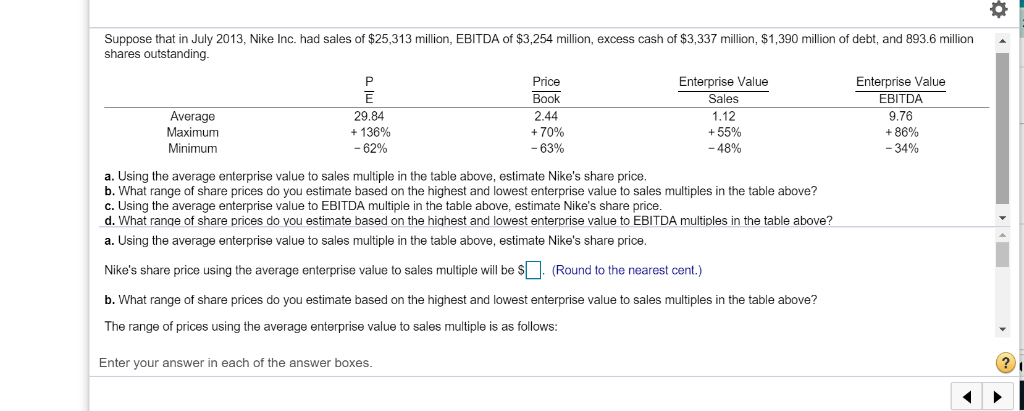

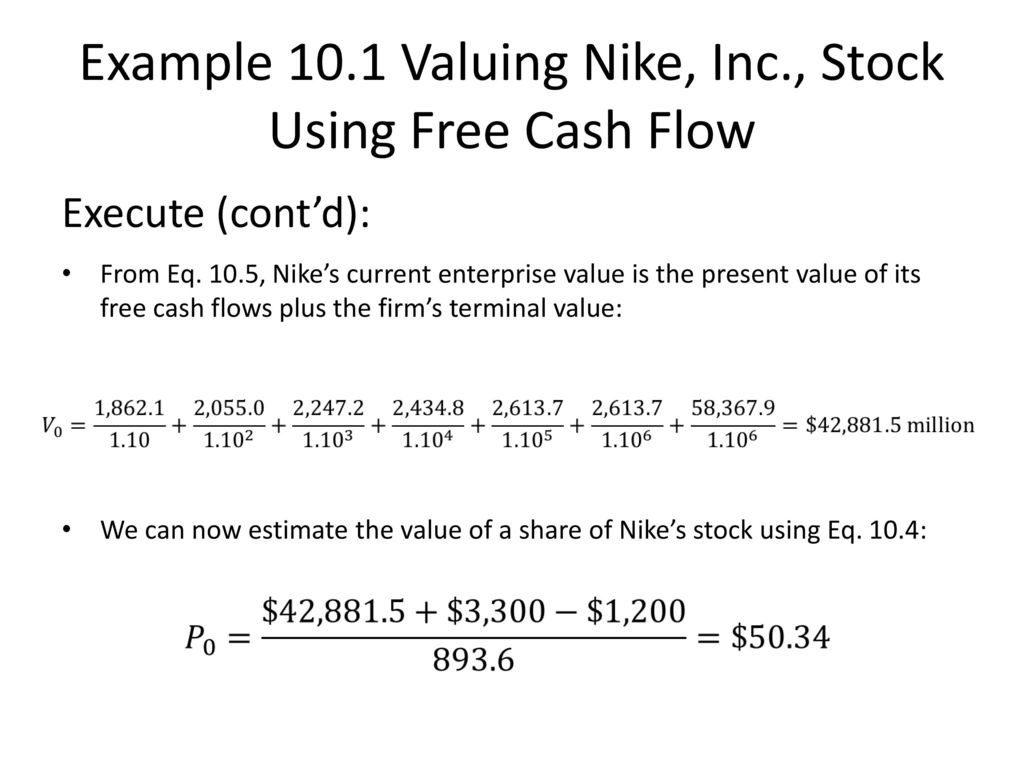

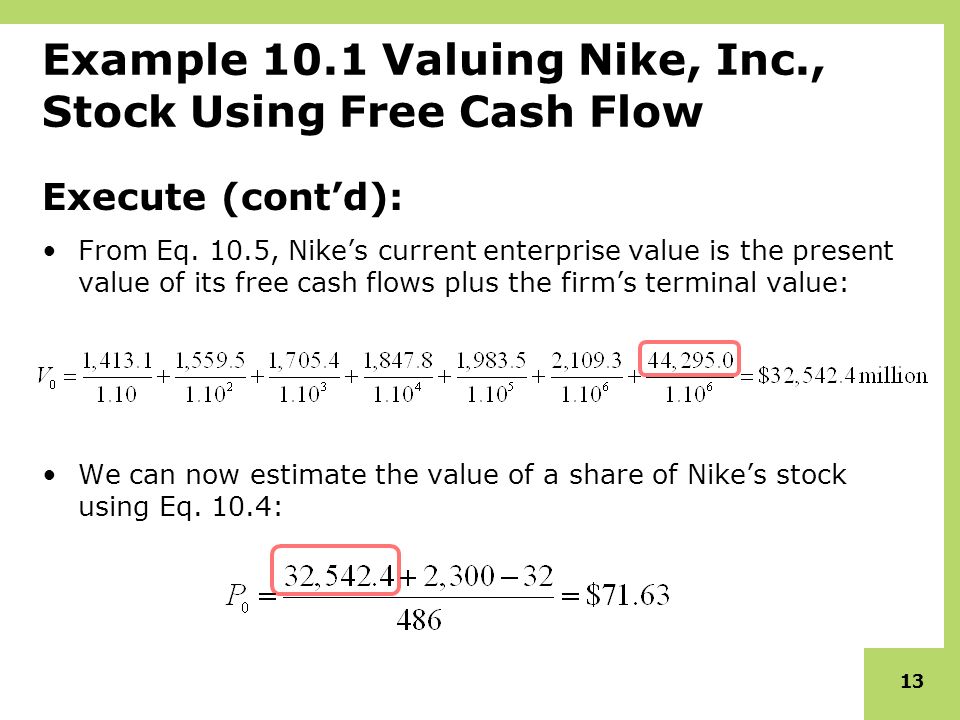

Problem 10-17.xlsx - Problem 10-17 Suppose that in July 2013 Nike had sales of $25 313 million EBITDA of $3 254 million excess cash of $3 337 | Course Hero

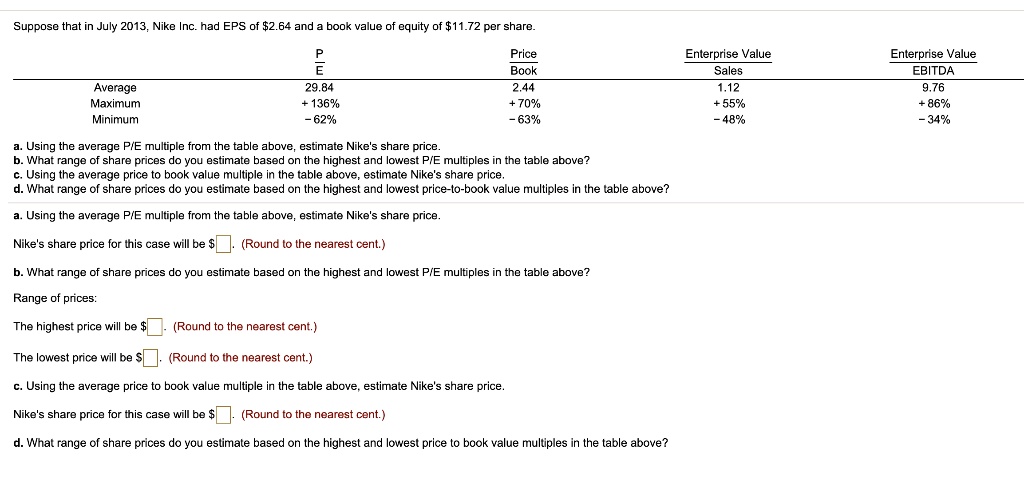

SOLVED: Suppose that in July 2013, Nike Inc. had EPS of 2.64 and a book value of equity of11.72 per share. |E 29.84 + 136% 62% Price Book 2.44 +70% -63% Enterprise

:max_bytes(150000):strip_icc()/GettyImages-1152522435-5e7fb93156e3488281174dbfd0bc70bc.jpg)